If two different amounts in the ratio 8:9 are invested in Companies P and Q respectively in 2002, then the amounts received after one year as interests from Companies P and Q are respectively in the ratio?

|

In 2000, a part of Rs. 30 lakhs was invested in Company P and the rest was invested in Company Q for one year. The total interest received was Rs. 2.43 lakhs. What was the amount invested in Company P? |

Answer |

|

An investor invested a sum of Rs. 12 lakhs in Company P in 1998. The total amount received after one year was re-invested in the same Company for one more year. The total appreciation received by the investor on his investment was? |

Answer |

|

An investor invested Rs. 5 lakhs in Company Q in 1996. After one year, the entire amount along with the interest was transferred as investment to Company P in 1997 for one year. What amount will be received from Company P, by the investor? |

Answer |

|

|

Answer |

|

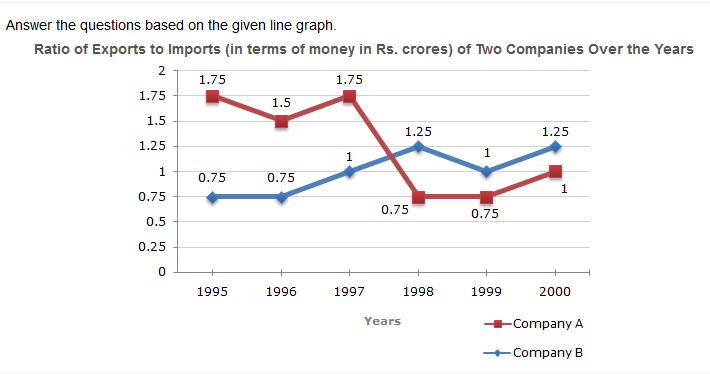

If the imports of Company A in 1997 were increased by 40 percent, what would be the ratio of exports to the increased imports? |

Answer |

|

If the exports of Company A in 1998 were Rs. 237 crores, what was the amount of imports in that year? |

Answer |

|

In 1995, the export of Company A was double that of Company B. If the imports of Company A during the year was Rs. 180 crores, what was the approximate amount of imports pf Company B during that year? |

Answer |

|

In which year(s) was the difference between impors and exports of Company B the maximum? |

Answer |

|

|

Answer |

|

If two different amounts in the ratio 8:9 are invested in Companies P and Q respectively in 2002, then the amounts received after one year as interests from Companies P and Q are respectively in the ratio? |

Answer |